Everything about Forex Spread Betting

Wiki Article

The Buzz on Forex Spread Betting

Table of ContentsThe Best Strategy To Use For Forex Spread BettingEverything about Forex Spread BettingRumored Buzz on Forex Spread Betting10 Easy Facts About Forex Spread Betting ShownMore About Forex Spread BettingThe Of Forex Spread Betting

Thus, along with the usual trading accounts with floating spread, a variety of companies offer clients supposed ECN accounts (Digital Communication Network). ECN Forex broker gives a system where individuals (financial institutions, market manufacturers as well as private financiers) profession with each various other, by placing deal orders in the system. Customarily, clients have lower spread trading on the ECN platform, however, at the same time, they pay compensation to the broker throughout their operation.Usually, by marketing drifting spread, brokers stress the element of being truly "market" kind as well as more slim than the fixed one. In theory this holds true, yet in real trading practice, especially in an active and unpredictable market, customers with floating spread face troubles to which they are not prepared. Among such issues is that the spread may raise approximately 8-10 pips for the major currency sets.

Specialist investors, regularly using stop orders, can not fully forecast their trade, as the broker can specifically interfere with the "stops", remembering the marketplace situation. Was this write-up helpful? Verify the concept on technique As soon as opened up Trial you will be supplied with academic products and also on-line assistance You can study CFD trading better and see CFD trading examples in the area Just how To Trade CFDs You can trade CFD completely free, by downloading our CFD Trading System Internet, Profession, X.

The 6-Second Trick For Forex Spread Betting

I have a customer that spends his working week on Foreign exchange trading. In the initial couple of years it has actually made a loss as well as we have asserted alleviation for this. HMRC are stating that this is not a trade as the client is not buying the currency and just hypothesizing. For the 2014/15 tax year the client has actually now earned a profit which I really hope will assist the instance.You can benefit from, wherein you just have to position a small down payment, or margin, to make a relatively huge trade. forex spread betting. Suppose, for instance, you intend to open a placement in Tesla shares worth 2000. The broker may offer you leverage of 5:1, so you would only have to take down 400.

Examine This Report on Forex Spread Betting

Spread wagers are ideal hedging tools due to the fact that you can use them to wager that an instrument will certainly increase or fall at a reasonably low expense. So, you can take a lengthy placement in shares in XYZ that will certainly benefit ought to the price rise, while getting a brief placement that will verify lucrative must the XYZ share price loss.

Expect, as an example, you have a typical profile of shares in international equities that you want to keep spent for the long term. Now imagine you prepare for that worldwide equities will certainly quickly encounter turbulence and also fall dramatically prior to remedying. You can sell all the shares in your portfolio in the idea that you'll be able to get them back at a much lower rate.

Examine This Report about Forex Spread Betting

Alternatively, an investor fearing a market modification might short-sell an equal quantity of spread bets in an index of global shares, enabling them to make the most of the short-term downtrend. At the same time, the financier continues to hold the shares within the financial investment portfolio, in the belief they will flourish in the lengthy term.They get autos at one rate as well as then offer Discover More them at a greater rate, as well as the distinction in between the 2 rates, or the "spread", generates their earnings. Spread wagering works in precisely the exact same means. In financial markets, you usually see two estimate for a tool such as a money set.

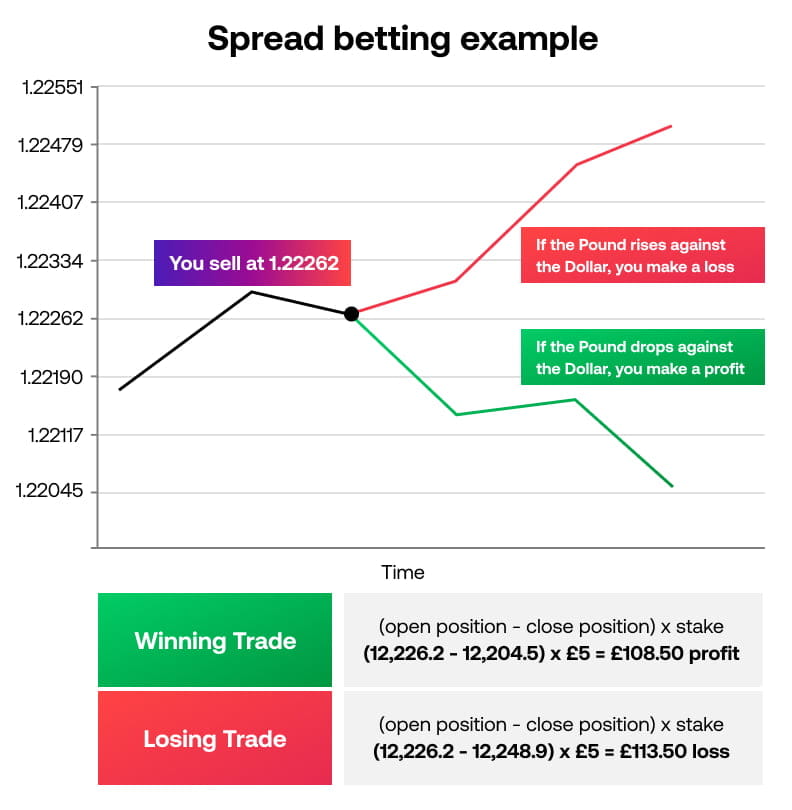

You place a spread bet based on whether you anticipate the rate of an instrument to rise or fall. If you anticipate the worth of a supply or bond will certainly climb, you would certainly open up a lengthy setting, where you are the buyer. By comparison, if you expect the price of the financial tool to fall, you would take a short placement, where you are the seller.

Facts About Forex Spread Betting Revealed

The rate at which investors can get a monetary instrument is constantly more than the sell rate, as well as the distinction or "spread out" supplies the broker with a small revenue to finance their procedures. A wider spread implies there is a better difference in between the two rates, which is generally an indication of low liquidity and high volatility.The bigger the spread, the higher the costs sustained by the investor. Spreads are measured in "pips", or rate passion factors, a dimension of the smallest rate step that a financial instrument can make. Many money pairs, for instance, are valued out to four decimal places and the pip is the last decimal point.

see here now

A Biased View of Forex Spread Betting

5 as well as has a click to investigate one-point spread, it would certainly have a deal cost of 5886 and also a bid cost of 5885, as portrayed in Number 1. Figure 1: Spread on the FTSE 100 Index. Resource: IG Markets The wager dimension in spread wagering refers to the amount that you desire to wager per system of motion in the tool you are trading.If the FTSE does certainly see a gain, climbing by 60 points, your earnings would be 300 (5 x 60), whereas if the index declined by 60 factors you would certainly experience a 300 loss Brokers step cost motions in the underlying market in factors (forex spread betting). A point of motion can stand for a pound, a penny and even one-hundredth of a penny.

Report this wiki page